May 2025 was a month of moderation, resilience, and strategic positioning for Indian equities. After a strong rally in March and April, the NIFTY 50 and Sensex continued to post gains, but at a slower pace, amid a complex backdrop of geopolitical tensions, global trade

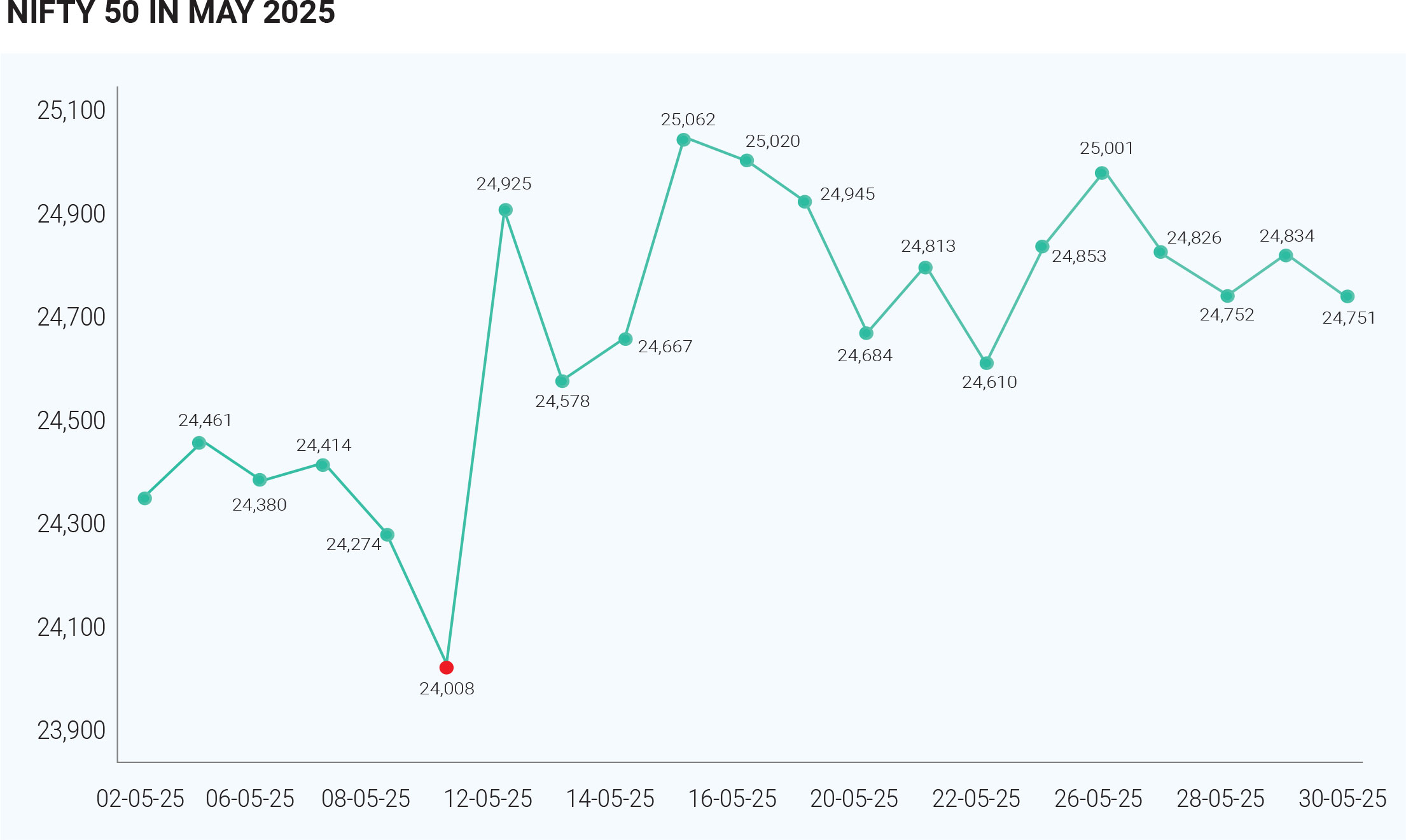

May 2025 was a month of moderation, resilience, and strategic positioning for Indian equities. After a strong rally in March and April, the NIFTY 50 and Sensex continued to post gains, but at a slower pace, amid a complex backdrop of geopolitical tensions, global trade uncertainty, strong corporate earnings, and evolving investor sentiment. While the market maintained positive momentum, signs of caution and consolidation emerged by month-end, indicating a potential inflection point ahead of June The NIFTY 50 index ended May at 24,750.70, up 1.7% for the month, while the Sensex closed at 81,451.01, posting a similar upward move. These gains extended the three-month rally that began in March, during which the NIFTY 50 rose approximately 12%, though the pace slowed month by month—6.3% in March, 3.5% in April, and 1.7% in May. On the final day of May, the Sensex shed 182 points, a signal that markets were beginning to digest earlier gains and reassess valuations in the face of emerging macro and geopolitical risks. A major storyline in May was India’s military action against terror targets in Pakistan and Pakistan-Occupied Kashmir, which initially sparked volatility and investor nervousness. However, markets quickly stabilized, supported by expectations of de-escalation and the relatively minor economic impact of bilateral trade with Pakistan. This demonstrated the Indian market’s increasing maturity and ability to absorb geopolitical shocks without prolonged disruption. Simultaneously, global trade developments remained a headwind. Uncertainty around tariffs, particularly in the US-China trade dialogue, weighed on global sentiment and kept Indian investors on alert. These external risks contributed to intermittent volatility and influenced foreign institutional positioning. Domestic macroeconomic data provided a constructive backdrop. Retail inflation dropped to a six-year low of 3.16% in April, well below the RBI’s 4% target. This unexpected softening fuelled expectations of further monetary easing by the Reserve Bank of India (RBI), especially with the next Monetary Policy Committee (MPC) meeting scheduled for early June. The prospect of rate cuts or continued accommodative policy was welcomed by markets, as it implies lower borrowing costs, stronger consumption, and enhanced liquidity—all key drivers for equity performance. Strong earnings performance played a crucial role in sustaining investor confidence during the month. Several large-cap companies posted better-than-expected quarterly results, led by sectors such as automobiles, real estate, metals, and financial services. Standout performers included Tata Motors, MRF, and Bajaj Finance, all of which reported robust revenue growth and profit margins. These results buoyed sectoral indices and contributed to broader market optimism. That said, not all sectors performed equally. FMCG and pharmaceutical companies lagged behind due to margin pressures and regulatory challenges, highlighting the importance of selective investing in the current environment. Indian stock markets in May 2025 experienced notable volatility, with sectoral performance showing clear distinctions between outperformers and underperformers. The Nifty Metal index was a standout, surging by 2.46% on key trading days. This was driven by strong aluminium prices, robust coal production, and expectations of higher demand from the power sector. The Nifty Energy index rose by 1.42% on certain sessions, buoyed by favourable oil price trends and increased demand for power during peak summer months. This sector benefited from both domestic policy support and global commodity dynamics. The Nifty IT index gained 1.34% in mid-May, supported by positive earnings and strong demand forecasts for tech services, particularly as global clients accelerated digital transformation projects. While the Nifty Auto index showed a 0.82% rise on some days, the sector was volatile overall. Positive production forecasts and government incentives provided support, but margin pressures and profit booking led to intermittent declines. The underperforming sectors during May are banking, FMCG, Pharma and consumer Durables & Oil & Gas. The Nifty Bank index declined by 0.25% on some days and by as much as 1.03% during sharp sell-offs. The sector was weighed down by regulatory concerns, mixed earnings, and global risk-off sentiment, leading to net outflows from institutional investors. The Nifty FMCG index remained largely flat or declined (down 1.44% on May 22), reflecting subdued rural demand, rising competition, and concerns over margin pressures. The infrastructure and small caps shown modest performance. Investor behaviour in May highlighted a notable divergence between foreign institutional investors (FIIs) and domestic investors. FIIs continued to be net buyers, infusing $2.66 billion into Indian equities from March to May. However, by the end of May, institutional investors began increasing their short positions in NIFTY futures, reaching the highest levels since February. This shift reflects rising caution, likely due to high valuations and global uncertainties. In contrast, retail investors and high-net-worth individuals (HNIs) remained bullish, adding to their long positions and showing confidence in India’s growth story. This divergence signals a market at a potential turning point, where momentum may either consolidate or shift depending on June’s macroeconomic and geopolitical signals. One of the most impressive indicators of market vibrancy in May was the performance of the GIFT Nifty—the international derivative contract tied to the NIFTY 50 index. The contract recorded monthly turnover of $102.35 billion, the highest ever, reflecting growing international investor participation and confidence in Indian equities. Such deepening liquidity not only strengthens India’s standing in global markets but also suggests that foreign capital remains engaged, even if selectively cautious. With major indices appearing overbought on certain indicators, and with global headwinds still in play, the market seems poised for a consolidation phase. Investors are now looking toward upcoming economic data, central bank commentary, and global developments to chart the next leg of the market’s direction. May 2025 saw Indian equity markets walk a tightrope between optimism and caution. While the NIFTY 50 and Sensex extended their gains on the back of strong earnings, supportive macro indicators, and healthy trading volumes, rising geopolitical risks, global uncertainties, and technical resistance moderated the market’s momentum. June begins and the investors are likely to remain selective and data-dependent, with a close eye on the RBI’s policy stance, geopolitical developments, and global risk cues. The coming month may not bring the same level of returns as the last quarter, but for disciplined investors, periods of consolidation often present valuable entry opportunities.

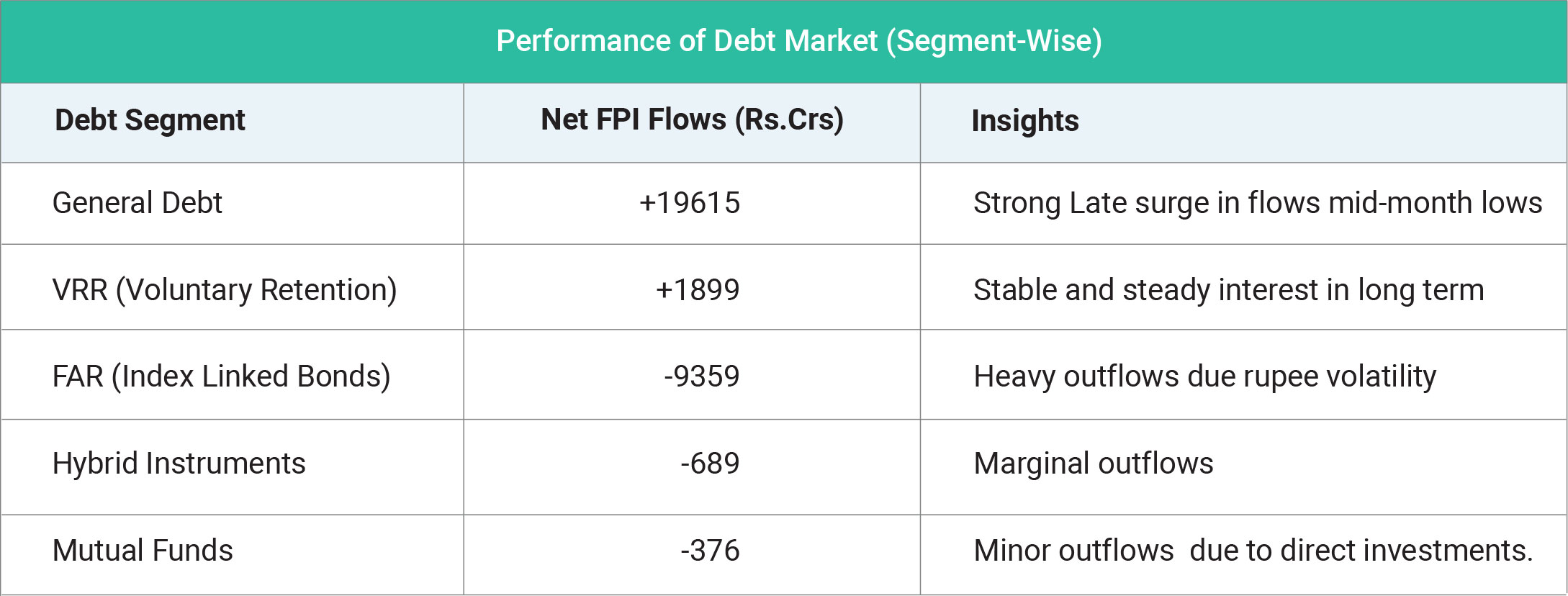

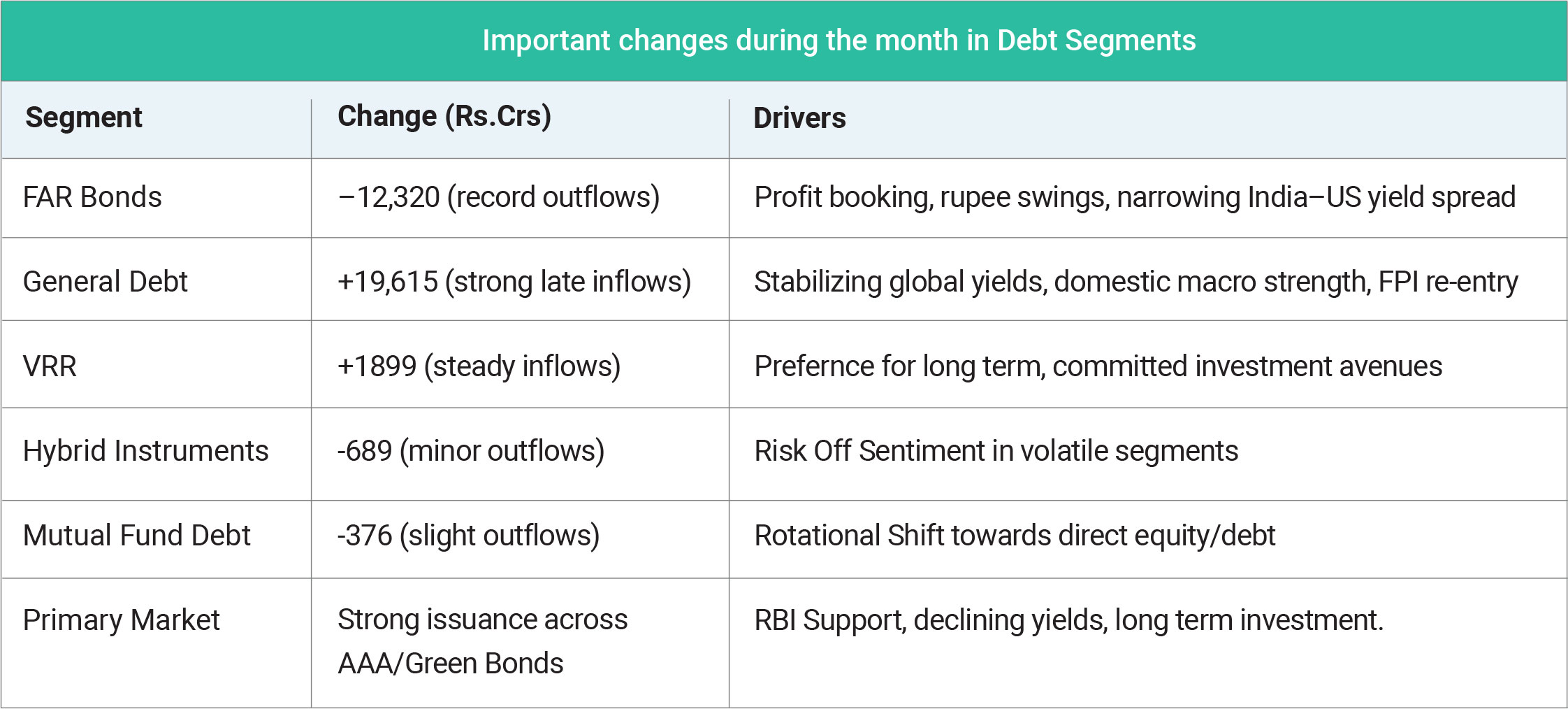

May 2025 was a dynamic and eventful month for India’s debt markets, characterized by robust foreign inflows, active central bank support, and sharp divergences across debt segments. Overall sentiment remained positive, driven by a surge in end-of-month foreign portfolio investment (FPI), easing inflation, and a liquidity-friendly monetary policy environment. Total FPI inflows into Indian debt stood at ₹12,000 crore in May, driven by a dramatic ₹27,115 crore purchase in the General Debt segment on May 30. This late-month spike offset earlier outflows and reaffirmed foreign investor confidence in India’s fixed income market. However, this optimism wasn’t uniform across all segments. The Fully Accessible Route (FAR), which includes bonds eligible for global index inclusion, witnessed record foreign selling, mainly due to profit-taking, rupee volatility, and narrowing yield differentials with U.S. Treasuries

May began with cautious FPI flows across debt segments, but sentiment improved sharply in the final week. The General Debt segment saw a remarkable reversal as foreign investors poured in ₹27,115 crore on May 30, signalling renewed appetite for Indian sovereign and corporate debt amid stable global yields and supportive macroeconomic signals. In contrast, the FAR segment recorded its steepest monthly outflow ever—₹12,320 crore, attributed primarily to profit-taking after a strong run, rising U.S. Treasury yields, and rupee depreciation pressures, rather than a structural shift in sentiment. The Reserve Bank of India (RBI) injected ₹1.25 lakh crore in liquidity through open market operations and repo interventions during May. This eased money market conditions, supported government bond prices, and helped 10-year G-Sec yields drift lower to 6.35%. With inflation at a six-year low and policy accommodative, the environment remained favourable for debt investors, particularly in medium- to long-duration bonds. Government bond yields declined steadily, underpinned by surplus liquidity, softening inflation, and expectations of dovish RBI guidance. This encouraged both institutional and retail investment in G-Secs and high-rated corporate bonds. Short-term instruments, including Treasury bills, PSU commercial paper (CP), and certificates of deposit (CDs), also saw rates soften, enhancing returns for short-duration and money market funds. Corporate bond yields continued to decline moderately, with sustained demand from domestic institutions. The spread between 10-year AAA-rated corporate bonds and G-Secs narrowed, reflecting an improved risk appetite and the market’s confidence in macroeconomic stability.

The Indian rupee remained volatile throughout May, influenced by geopolitical developments and rising global bond yields. As the yield gap between Indian debt and U.S. Treasuries narrowed, foreign investors rebalanced portfolios, particularly in the FAR/index-linked bonds, which are sensitive to global capital flows. Despite these headwinds, the underlying strength of India’s domestic economy and the RBI’s liquidity stance mitigated broader risks. The primary debt market was active, with high demand for new issuances, particularly in: AAA-rated corporate bonds, Infrastructure bonds and Green energy bonds. The favourable interest rate environment and robust investor appetite ensured smooth absorption of supply, reinforcing confidence in long-duration, high-quality debt

The Indian debt market in May 2025 reflected a nuanced interplay of domestic strength and global headwinds. While profit-taking and rupee volatility triggered heavy selling in index-linked (FAR) bonds, the broader market sentiment remained resilient, thanks to late-month FPI inflows into General Debt, RBI liquidity support, and softening yields. Demand for high-quality corporate and green bonds in the primary market further underscored investors’ confidence in India's long-term fundamentals. Going into June, debt market participants will be watching the RBI’s policy stance, currency stability, and global rate trends, which will be crucial in sustaining momentum across segments.

In May 2025, crude oil prices in India showed a modest recovery, trading between $58.92 and $63.67 per barrel and ending the month at $60.79 per barrel. The Indian crude basket averaged $63.84, a slight rebound from April’s steep drop, when prices had fallen from above $71 to under $59. Though the 3% monthly gain reflected some stabilization, prices remained significantly below early-2025 highs. The global market continued to struggle with oversupply and weak demand, which kept price momentum subdued. A major contributor to this environment was OPEC+’s decision to increase output by 411,000 barrels per day in May, adding to global inventories. The Indian Petroleum Ministry emphasized that global supply remained ample, making a return to $80 levels unlikely in the near term. Demand concerns, stemming from US-China trade tensions and fears of a global slowdown, further capped gains. Moreover, OPEC+ signalled plans for another production hike in June, reinforcing expectations of a supply-heavy market. This soft pricing landscape had a mixed impact on India. For oil marketing companies (OMCs), lower crude costs improved marketing margins for petrol and diesel, partially offsetting recent excise duty hikes. Expectations of a decline in domestic natural gas prices also rose, with potential relief for CNG and PNG consumers. Yet, Indian retail fuel prices stayed relatively unchanged, highlighting the disconnect between international crude trends and domestic pump prices. This divergence stems largely from India’s layered pricing system. Heavy central and state taxes—excise duties and VAT—form a large portion of the final retail price, often muting the effect of falling global prices. OMCs, though technically free to revise prices daily, frequently delay changes due to political pressures or inflation concerns, especially during sensitive periods like elections. Currency fluctuations also influence domestic pricing. A weaker rupee increases import costs, countering benefits from cheaper crude, while a stronger rupee can soften the impact of rising prices. Additionally, OMCs often use low-price periods to recover past losses from previous price freezes, prioritizing financial stability over immediate consumer relief. Though India formally deregulated fuel prices, government influence still persists in the form of implicit guidance or strategic intervention. Overall, while global crude prices in May 2025 modestly rebounded and supported refiners’ margins, Indian consumers saw limited benefit due to high taxes, currency volatility, OMC pricing strategies, and legacy policy structures that continue to shape the domestic fuel market.

In May 2025, India’s bullion market exhibited a mix of volatility and strength, ultimately closing the month on a positive note. Gold prices fluctuated but showed a general upward trend, with 24K gold priced around ₹9,599 per gram on May 28, dropping slightly to ₹9,544 on May 30 before climbing to ₹9,764 by June 2. This late surge reflected heightened investor interest and safe-haven demand triggered by global tensions. Silver prices moved similarly, ranging between ₹99,000 and ₹100,000 per kilogram, eventually reaching ₹100 per gram by early June, in response to both global cues and domestic demand. One of the most influential drivers of bullion prices was increased geopolitical uncertainty. The continuation of the Ukraine-Russia war and rising US-China trade tensions unsettled financial markets and boosted global demand for gold and silver. This led to significant price gains in Indian markets, especially during the last week of May, as investors turned to bullion to hedge against growing economic risks. On the monetary front, anticipation of US inflation data and potential Federal Reserve rate hikes added to global market anxiety. A stronger US dollar, driven by higher US yields and safe-haven demand, led to short-term price corrections in Indian gold. For instance, 24K gold dropped ₹44 per gram on May 29. Despite this, gold prices rebounded quickly, supported by the Reserve Bank of India’s cautious monetary stance, which provided some stability. Historically, policy uncertainty tends to strengthen gold’s appeal in India, as investors seek protection from volatile macroeconomic signals. On the domestic front, a stronger Indian rupee helped soften the impact of global price fluctuations. While the rupee’s appreciation dampened some of the price rises, it wasn’t enough to fully offset the bullish trend driven by global demand. Seasonal factors also played a role—particularly the Akshaya Tritiya festival on April 30, which traditionally sees strong gold buying. Although jewellery demand was muted due to high and unstable prices, bars, coins, and digital gold saw increased interest, particularly in culturally significant regions like South India. From an investment perspective, gold ETFs saw redemptions as some investors booked profits, yet overall participation remained strong. Imports stayed resilient, and with no major government policy changes in May, global factors remained the dominant market drivers. Overall, Indian bullion in May 2025 reflected its role as a safe-haven asset, finishing the month with a clear upward bias driven by global uncertainty and cultural demand.

In May 2025, the Indian rupee followed a broadly stable but mildly weakening trajectory against the US dollar, trading between ₹84.22 and ₹85.99 per dollar. The currency began the month on a strong note, reaching its best level of the year at ₹84.22 on May 5, but gradually depreciated, ending near ₹85.57 on May 31. This downward drift was shaped by a mix of global and domestic influences, including US monetary policy, foreign investment flows, commodity prices, and domestic policy expectations. Globally, a key driver was the sustained strength of the US dollar. Investor expectations that US interest rates would remain elevated—alongside rising Treasury yields and demand for safe-haven assets amid geopolitical tensions—made dollar assets more attractive. This put consistent pressure on emerging market currencies, including the rupee. Meanwhile, global crude oil prices increased India’s import bill, widened the trade deficit, and added to dollar demand, further weakening the rupee. Foreign portfolio investment (FPI) activity also impacted the rupee. Although Indian markets saw strong FPI inflows, selective outflows from FAR bonds and profit-booking capped any gains. On the domestic front, expectations of monetary easing by the Reserve Bank of India, which later cut rates by 25 basis points, led to concerns over reduced yield attractiveness, prompting capital outflows. Additional risk aversion due to tariff uncertainties and border tensions made the rupee Asia’s worst-performing currency in May, with a nearly 1% decline. Despite these pressures, the Reserve Bank of India maintained currency stability through periodic intervention, preventing sharp volatility without fixing any specific rate level. This balanced approach allowed the rupee to weaken steadily in line with global trends. Moving forward, the rupee’s path will be shaped by global interest rates, oil prices, inflation data, and the RBI’s monetary policy direction.

In May 2025, the Indian mutual fund industry witnessed a robust performance across all major segments, reflecting strong investor sentiment and favourable macroeconomic conditions. Equity mutual funds were the standout performers, with every category ending the month in positive territory. Smallcap funds led the rally with an average monthly return of 8.2%, driven by increased investor interest in emerging opportunities and valuations in the smaller-cap segment. Midcap and multi-cap/flexicap funds also delivered solid gains, as a shift in market sentiment toward broader participation lifted performance across the board. Largecap funds recorded a more modest average return of 2.22%, although some top-performing schemes neared 4%. Sectoral and thematic funds delivered mixed results; while contra funds earned an average of 3.13%, pharma and healthcare sector funds underperformed, posting the lowest average equity category return at just 1.15%. Defence sector funds continued their strong year-to-date performance, while gold and BFSI (banking, financial services, and insurance) funds benefited from market uncertainty and investor hedging strategies. In the debt segment, falling bond yields—declining from 6.32% to 6.18% on the 10-year benchmark—contributed to mark-to-market gains, especially for long-duration funds. Expectations of a potential RBI rate cut in June, a lower fiscal deficit, and relaxed FPI norms supported strong inflows into debt funds. Although overall debt fund inflows rebounded sharply, the total number of folios in income-oriented schemes fell by 3% year-on-year, indicating a gradual investor shift toward equity and hybrid options. Hybrid funds sustained their popularity, with folios rising 16.1% over the year, reflecting interest in balanced strategies. Passive investing continued its momentum, with index funds and ETFs seeing a 48.3% surge in folio count. The industry as a whole reached new milestones, with assets under management (AUM) hitting a record ₹69.5 trillion by April-end and total folios crossing 23.6 crore—up 32% from the previous year. Systematic Investment Plans (SIPs) maintained healthy momentum, with monthly contributions exceeding ₹26,600 crore and accounting for over 20% of total AUM. Additionally, May saw record foreign portfolio investor (FPI) inflows of ₹19,860 crore into equities and ₹11,090 crore into debt—the highest in 2025—further boosting performance and reinforcing market confidence.

In May 2025, India’s insurance sector witnessed

transformative changes, led by the landmark policy

allowing 100% foreign direct investment (FDI) under the

automatic route, as announced in the Union Budget

2025–26. This move aims to attract global capital, boost

competition, and foster innovation, with the condition

that all premium collections remain invested within India.

The Finance Minister also signalled further liberalization

by promising to review and simplify foreign investment

regulations. Simultaneously, the Insurance Regulatory

and Development Authority of India (IRDAI) initiated a

legal overhaul, forming a seven-member committee

propose amendments to the Insurance Act, 1938.

Proposed reforms such as risk-based solvency norms

and changes to surrender policies are intended to

modernize the sector and enhance capital efficiency.

Industry performance remained robust, with non-life

insurance premiums growing 13.5% year-on-year in April

2025, totalling ₹33,688.5 crore. The sector also crossed

the ₹3 lakh crore premium mark for FY25, with

projections indicating 7.1% annual growth through

2028—making it the fastest-growing insurance market

among G20 nations. The FDI limit hike triggered

immediate positive stock market reactions, with major

insurers like SBI Life and HDFC Life gaining over 3%,

reflecting investor confidence. The policy change also

paves the way for increased mergers, restructuring of

joint ventures, and entry of new foreign players, reshaping

the competitive landscape. The planned composite

license regime, allowing insurers to operate across life,

health, and general segments, is expected to further

intensify competition. Additionally, the push toward

digital transformation continues through initiatives like

Bima Sugam, Bima Vistaar, and Bima Vahaks, aimed at

improving access and innovation, especially in

underserved areas. Regulatory safeguards remain in

place to ensure sectoral stability, including domestic

investment mandates and governance norms. Overall,

May 2025 marked a turning point for Indian insurance,

setting the stage for rapid expansion, enhanced investor

participation, and improved consumer outcomes.

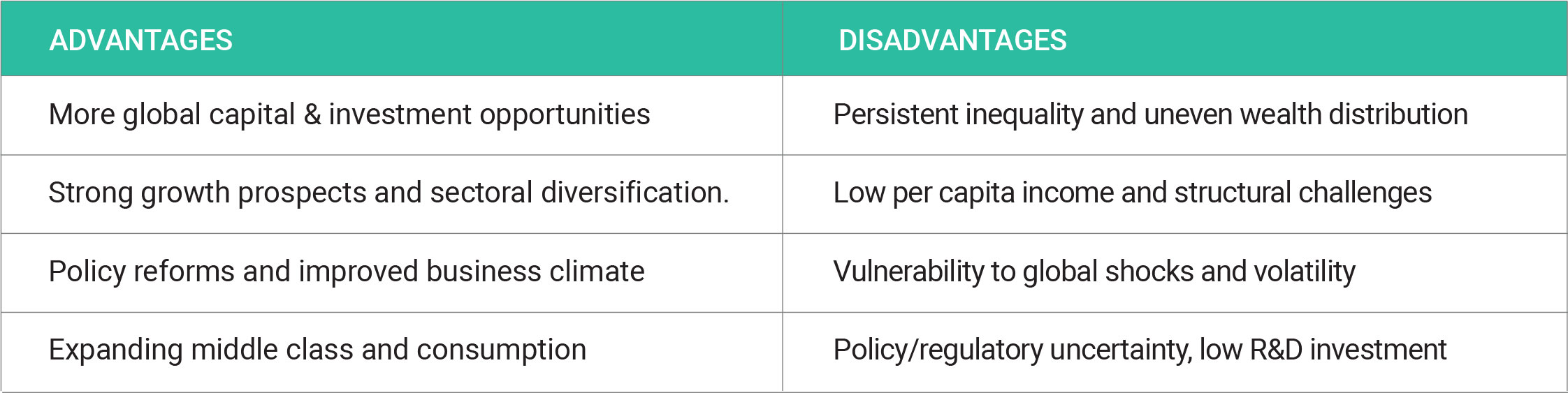

INDIA BECOMES THE 4TH LARGEST ECONO MY - ADVANTAGES AND DISADVANTAGES

India’s rise to the 4th largest economy brings Indian

investors more global opportunities, sectoral growth, and

policy support, but also exposes them to persistent

inequality, structural challenges, and greater vulnerability

to global shocks. The benefits for investors will depend

on how inclusively and sustainably this growth is

managed.

Copyright © 2021 Fintso