May 2025 was a month of moderation, resilience, and strategic positioning for Indian equities. After a strong rally in March and April, the NIFTY 50 and Sensex continued to post gains, but at a slower pace, amid a complex backdrop of geopolitical tensions, global trade

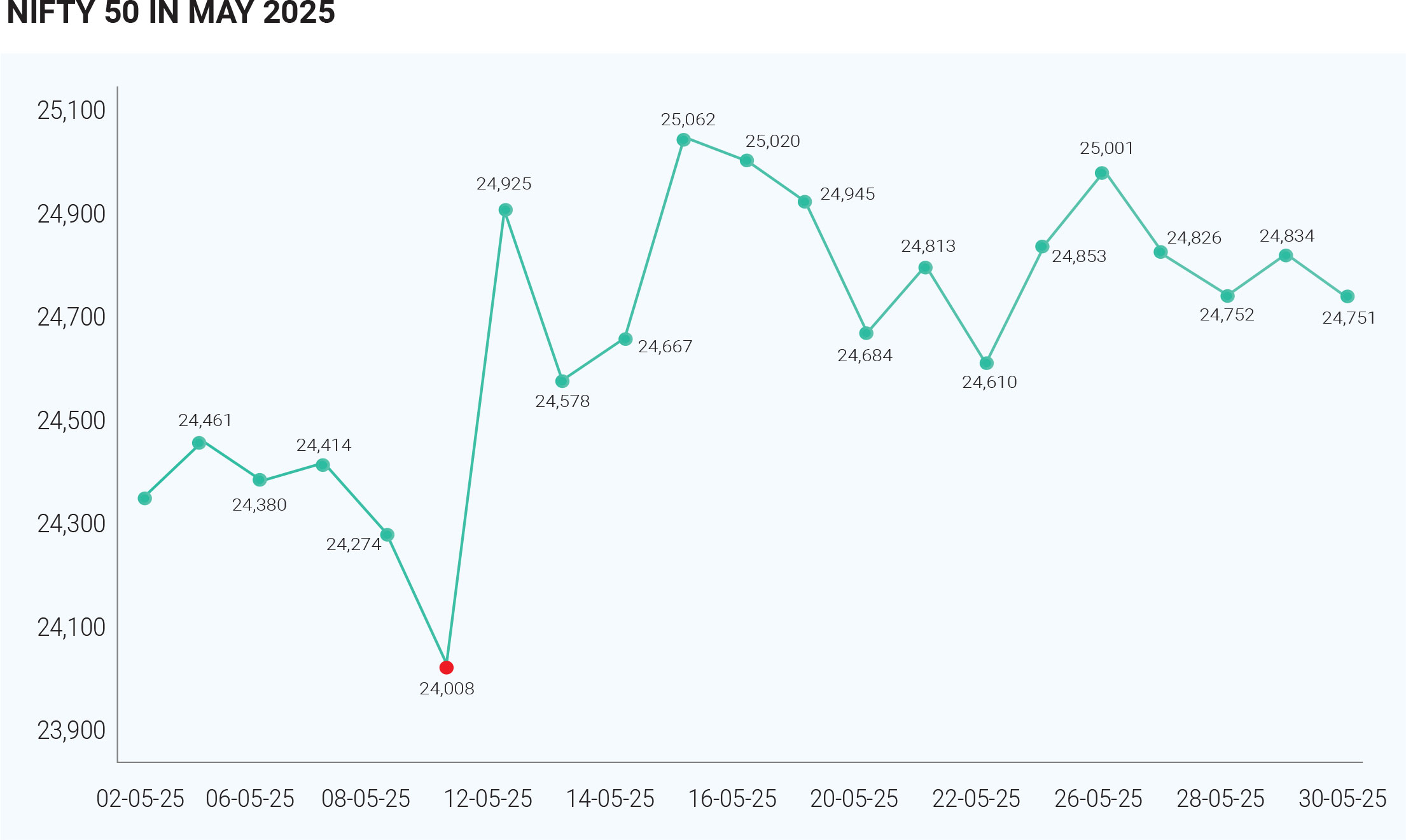

May 2025 was a month of moderation, resilience, and strategic positioning for Indian equities. After a strong rally in March and April, the NIFTY 50 and Sensex continued to post gains, but at a slower pace, amid a complex backdrop of geopolitical tensions, global trade uncertainty, strong corporate earnings, and evolving investor sentiment. While the market maintained positive momentum, signs of caution and consolidation emerged by month-end, indicating a potential inflection point ahead of June The NIFTY 50 index ended May at 24,750.70, up 1.7% for the month, while the Sensex closed at 81,451.01, posting a similar upward move. These gains extended the three-month rally that began in March, during which the NIFTY 50 rose approximately 12%, though the pace slowed month by month—6.3% in March, 3.5% in April, and 1.7% in May. On the final day of May, the Sensex shed 182 points, a signal that markets were beginning to digest earlier gains and reassess valuations in the face of emerging macro and geopolitical risks. A major storyline in May was India’s military action against terror targets in Pakistan and Pakistan-Occupied Kashmir, which initially sparked volatility and investor nervousness. However, markets quickly stabilized, supported by expectations of de-escalation and the relatively minor economic impact of bilateral trade with Pakistan. This demonstrated the Indian market’s increasing maturity and ability to absorb geopolitical shocks without prolonged disruption. Simultaneously, global trade developments remained a headwind. Uncertainty around tariffs, particularly in the US-China trade dialogue, weighed on global sentiment and kept Indian investors on alert. These external risks contributed to intermittent volatility and influenced foreign institutional positioning. Domestic macroeconomic data provided a constructive backdrop. Retail inflation dropped to a six-year low of 3.16% in April, well below the RBI’s 4% target. This unexpected softening fuelled expectations of further monetary easing by the Reserve Bank of India (RBI), especially with the next Monetary Policy Committee (MPC) meeting scheduled for early June. The prospect of rate cuts or continued accommodative policy was welcomed by markets, as it implies lower borrowing costs, stronger consumption, and enhanced liquidity—all key drivers for equity performance. Strong earnings performance played a crucial role in sustaining investor confidence during the month. Several large-cap companies posted better-than-expected quarterly results, led by sectors such as automobiles, real estate, metals, and financial services. Standout performers included Tata Motors, MRF, and Bajaj Finance, all of which reported robust revenue growth and profit margins. These results buoyed sectoral indices and contributed to broader market optimism. That said, not all sectors performed equally. FMCG and pharmaceutical companies lagged behind due to margin pressures and regulatory challenges, highlighting the importance of selective investing in the current environment. Indian stock markets in May 2025 experienced notable volatility, with sectoral performance showing clear distinctions between outperformers and underperformers. The Nifty Metal index was a standout, surging by 2.46% on key trading days. This was driven by strong aluminium prices, robust coal production, and expectations of higher demand from the power sector. The Nifty Energy index rose by 1.42% on certain sessions, buoyed by favourable oil price trends and increased demand for power during peak summer months. This sector benefited from both domestic policy support and global commodity dynamics. The Nifty IT index gained 1.34% in mid-May, supported by positive earnings and strong demand forecasts for tech services, particularly as global clients accelerated digital transformation projects. While the Nifty Auto index showed a 0.82% rise on some days, the sector was volatile overall. Positive production forecasts and government incentives provided support, but margin pressures and profit booking led to intermittent declines. The underperforming sectors during May are banking, FMCG, Pharma and consumer Durables & Oil & Gas. The Nifty Bank index declined by 0.25% on some days and by as much as 1.03% during sharp sell-offs. The sector was weighed down by regulatory concerns, mixed earnings, and global risk-off sentiment, leading to net outflows from institutional investors. The Nifty FMCG index remained largely flat or declined (down 1.44% on May 22), reflecting subdued rural demand, rising competition, and concerns over margin pressures. The infrastructure and small caps shown modest performance. Investor behaviour in May highlighted a notable divergence between foreign institutional investors (FIIs) and domestic investors. FIIs continued to be net buyers, infusing $2.66 billion into Indian equities from March to May. However, by the end of May, institutional investors began increasing their short positions in NIFTY futures, reaching the highest levels since February. This shift reflects rising caution, likely due to high valuations and global uncertainties. In contrast, retail investors and high-net-worth individuals (HNIs) remained bullish, adding to their long positions and showing confidence in India’s growth story. This divergence signals a market at a potential turning point, where momentum may either consolidate or shift depending on June’s macroeconomic and geopolitical signals. One of the most impressive indicators of market vibrancy in May was the performance of the GIFT Nifty—the international derivative contract tied to the NIFTY 50 index. The contract recorded monthly turnover of $102.35 billion, the highest ever, reflecting growing international investor participation and confidence in Indian equities. Such deepening liquidity not only strengthens India’s standing in global markets but also suggests that foreign capital remains engaged, even if selectively cautious. With major indices appearing overbought on certain indicators, and with global headwinds still in play, the market seems poised for a consolidation phase. Investors are now looking toward upcoming economic data, central bank commentary, and global developments to chart the next leg of the market’s direction. May 2025 saw Indian equity markets walk a tightrope between optimism and caution. While the NIFTY 50 and Sensex extended their gains on the back of strong earnings, supportive macro indicators, and healthy trading volumes, rising geopolitical risks, global uncertainties, and technical resistance moderated the market’s momentum. June begins and the investors are likely to remain selective and data-dependent, with a close eye on the RBI’s policy stance, geopolitical developments, and global risk cues. The coming month may not bring the same level of returns as the last quarter, but for disciplined investors, periods of consolidation often present valuable entry opportunities.