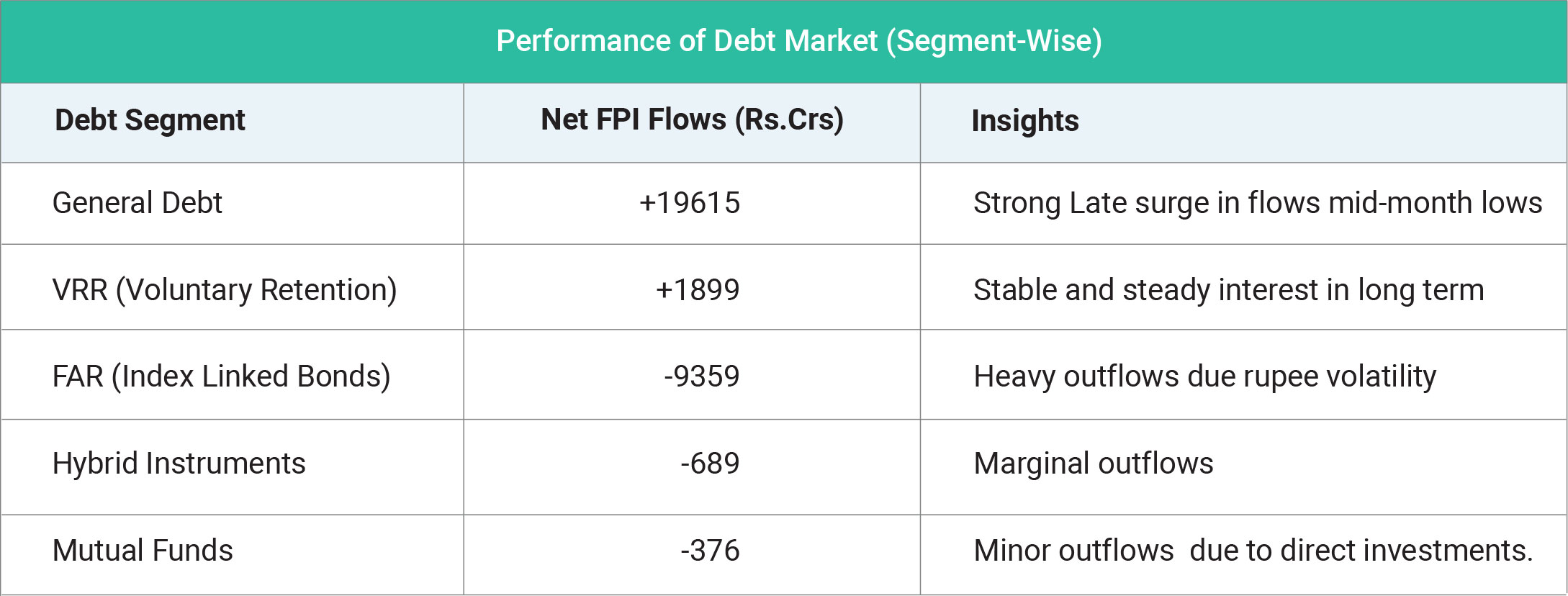

May 2025 was a dynamic and eventful month for India’s debt markets, characterized by robust foreign inflows, active central bank support, and sharp divergences across debt segments. Overall sentiment remained positive, driven by a surge in end-of-month foreign portfolio investment (FPI), easing inflation, and a liquidity-friendly monetary policy environment. Total FPI inflows into Indian debt stood at ₹12,000 crore in May, driven by a dramatic ₹27,115 crore purchase in the General Debt segment on May 30. This late-month spike offset earlier outflows and reaffirmed foreign investor confidence in India’s fixed income market. However, this optimism wasn’t uniform across all segments. The Fully Accessible Route (FAR), which includes bonds eligible for global index inclusion, witnessed record foreign selling, mainly due to profit-taking, rupee volatility, and narrowing yield differentials with U.S. Treasuries

May began with cautious FPI flows across debt segments, but sentiment improved sharply in the final week. The General Debt segment saw a remarkable reversal as foreign investors poured in ₹27,115 crore on May 30, signalling renewed appetite for Indian sovereign and corporate debt amid stable global yields and supportive macroeconomic signals. In contrast, the FAR segment recorded its steepest monthly outflow ever—₹12,320 crore, attributed primarily to profit-taking after a strong run, rising U.S. Treasury yields, and rupee depreciation pressures, rather than a structural shift in sentiment. The Reserve Bank of India (RBI) injected ₹1.25 lakh crore in liquidity through open market operations and repo interventions during May. This eased money market conditions, supported government bond prices, and helped 10-year G-Sec yields drift lower to 6.35%. With inflation at a six-year low and policy accommodative, the environment remained favourable for debt investors, particularly in medium- to long-duration bonds. Government bond yields declined steadily, underpinned by surplus liquidity, softening inflation, and expectations of dovish RBI guidance. This encouraged both institutional and retail investment in G-Secs and high-rated corporate bonds. Short-term instruments, including Treasury bills, PSU commercial paper (CP), and certificates of deposit (CDs), also saw rates soften, enhancing returns for short-duration and money market funds. Corporate bond yields continued to decline moderately, with sustained demand from domestic institutions. The spread between 10-year AAA-rated corporate bonds and G-Secs narrowed, reflecting an improved risk appetite and the market’s confidence in macroeconomic stability.