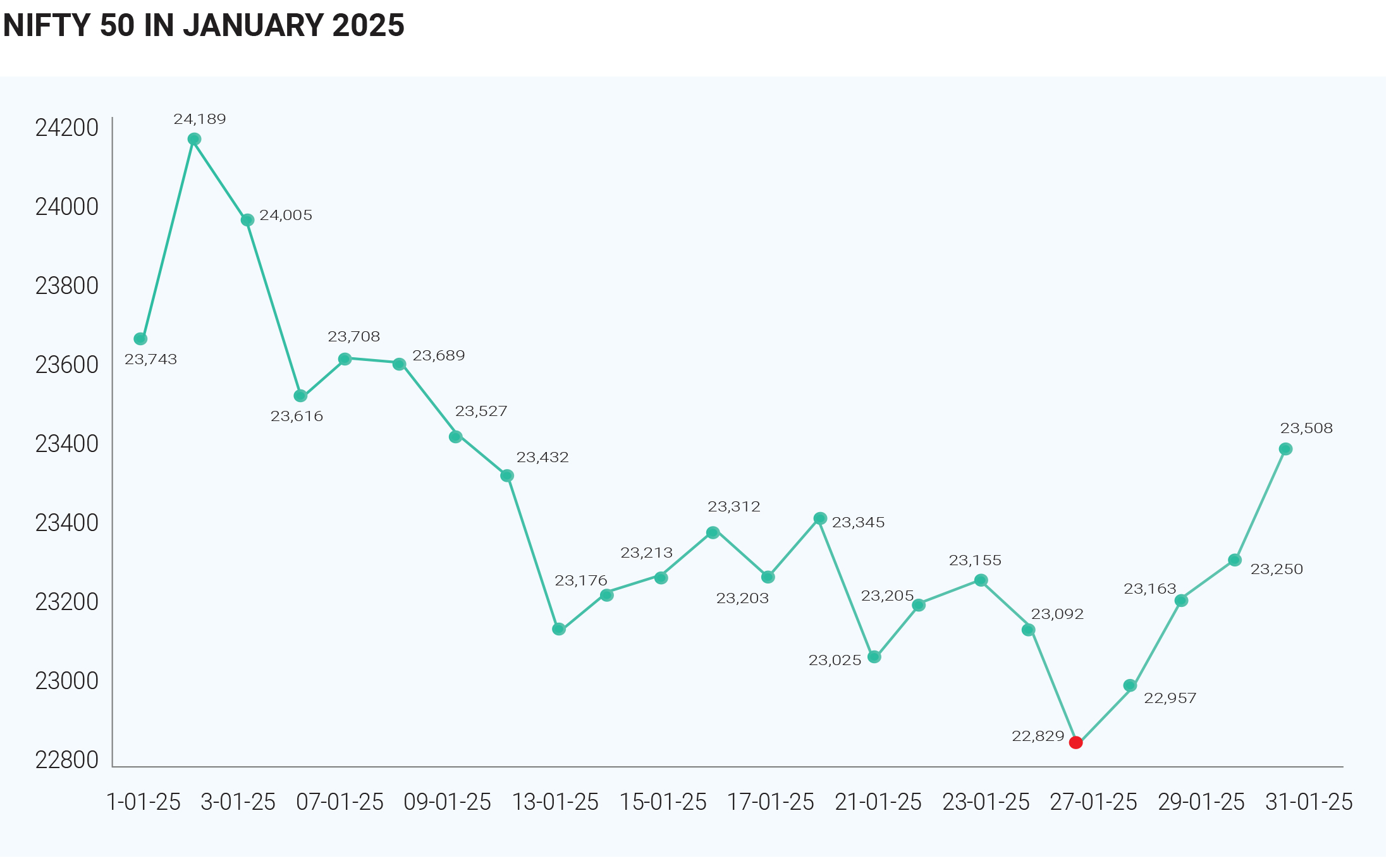

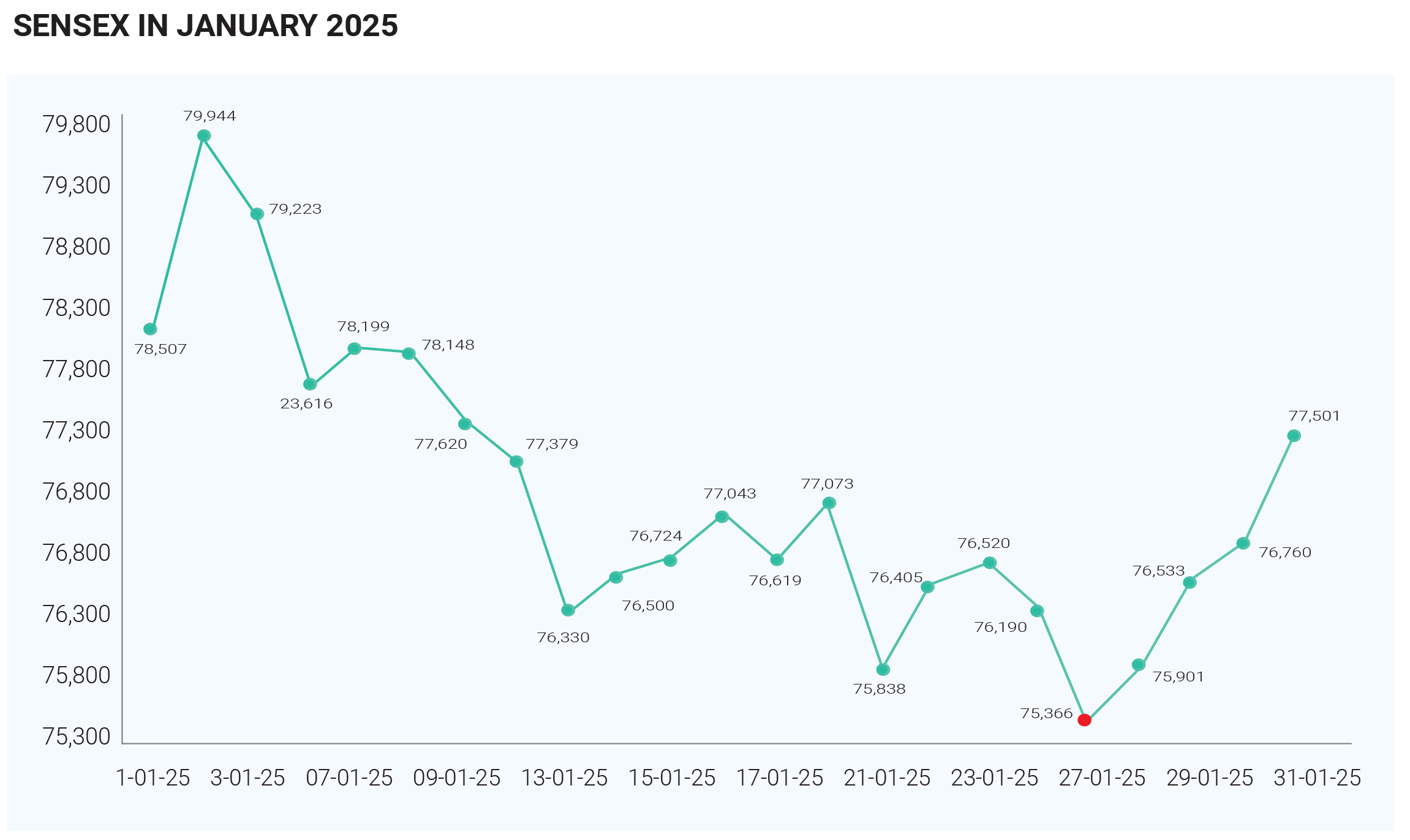

January 2025 proved to be one of the most challenging months for the Indian stock markets in over two decades, as both the Sensex and Nifty indices faced significant downturns. The Sensex declined by around 2%, opening at approximately 78,507 points and closing the month at

Foreign Institutional Investors (FIIs) sold equities worth approximately ₹87,374 crore (around $10.5 billion) in January, marking the largest monthly outflow ever recorded for January and one of the highest in any month historically. This aggressive sell-off hit key sectors hard: Financial Sector: ₹12,200 crore, Consumer Services: ₹3,500 crore, Power Sector: ₹3,115 crore and Capital Goods: ₹2,620 crore Several factors drove this FII exodus, including elevated market valuations, a depreciating Indian rupee against the dollar, rising U.S. Treasury yields, and the imposition of tariffs by the U.S. government on key trading partners, which disrupted global economic stability. The announcement of new tariffs by the Trump administration on imports from major trading partners 76,759 points. Similarly, the Nifty fell from an opening of 23,742 to 23,205 by the end of the month. The decline was attributed to a combination of external economic pressures and domestic factors, creating a turbulent environment for investors.

The Indian market's decline mirrored broader trends in global equities. Poor performance in Asian markets, particularly a 2.56% drop in Japan’s Nikkei, highlighted growing fears of an economic slowdown. Weak global factory activity further fuelled concerns, contributing to market declines across India. On the domestic front, inflation emerged as a major rate-cut cycle by the RBI in early 2025, contingent on inflation data. A reduction of 50 basis points over two policy announcements was under consideration, although any decision would be highly dependent on the inflation trajectory and broader economic conditions. The last week of January saw a glimmer of hope as equity markets began to recover. The sentiment was boosted by the RBI’s announcement of several measures to inject over ₹1 lakh crore of liquidity into the banking system. This move raised expectations of monetary policy easing in the RBI’s February 2025 meeting. Additionally, encouraging earnings updates from prominent U.S. tech companies helped offset fears stemming from renewed tariff threats by the U.S. President and concerns over China’s advancements in artificial intelligence, particularly following the launch of Deepseek. The challenges faced in January 2025 underscore the complex environment for Indian stock markets, shaped by global economic policies, significant FII sell-offs, and domestic economic concerns. As February unfolds, continued volatility is anticipated, driven by global economic conditions and local political events. While there may be opportunities for stock-specific gains, investors are advised to remain vigilant and prepared for market fluctuations as both domestic and international developments continue to influence sentiment.

The Indian debt market underwent significant changes in January 2025, primarily due to increased borrowing by state governments and evolving economic dynamics. State administrations announced plans to issue bonds worth ₹4.73 trillion (approximately $55.29 billion) in the first quarter of 2025, surpassing market expectations of around ₹4 trillion. This sharp increase raised concerns about potential upward pressure on bond yields. The yield on the benchmark 10-year government bond hovered between 6.74% and 6.77%, reflecting a slight uptick. This movement was attributed to the surge in bond supply and global trends, particularly rising U.S. Treasury yields, which narrowed the yield spread between Indian and U.S. bonds to its lowest point in two decades. Investor sentiment remained cautious as market participants recalibrated strategies in response to the unexpected borrowing hike. The increased bond supply led to heightened scrutiny from traders, potentially impacting market liquidity. Despite persistent inflationary pressures, speculation grew about potential interest rate cuts by the Reserve Bank of India (RBI) later in the year if inflation cools. Such a move could enhance the attractiveness of fixed-income investments, especially if yields stabilize or decline. Corporate bond issuances remained robust, reaching a record ₹10.67 trillion by December 2024. This trend highlighted strong demand for corporate financing despite challenges in secondary market trading volumes. Global economic trends continued to influence the Indian debt market. Rising interest rates and tightening monetary policies in developed economies created ripple effects across emerging markets, including India. However, there is optimism about growth opportunities, particularly with India’s expected inclusion in major global bond indices, which could attract substantial inflows into government securities and corporate bonds. The Indian debt market, characterized by increased state borrowing and rising bond yields, faces challenges and growth prospects. Inflation concerns and global monetary policy shifts persist, but anticipated rate adjustments and India’s growing prominence in global debt markets present promising opportunities for investors.

Crude oil prices in India experienced a significant decline throughout January 2025 due to a combination of global and domestic influences. At the start of the month, Brent crude oil stood at approximately $80.79 per barrel on January 17. By January 24, prices had dipped to around $78.26 per barrel. Although the Indian basket price recovered slightly to $80.49 per barrel by January 28, the overall trend remained downward. One major factor contributing to the decline was the easing of geopolitical tensions. Market analysts observed growing optimism regarding a potential resolution to the Ukraine-Russia conflict, reducing the geopolitical risk premium that had previously supported higher oil prices. Additionally, expectations of increased oil production in the United States under the new administration further influenced market dynamics. Following President Donald Trump’s inauguration, there were strong signals of heightened U.S. energy output. Trump declared a national energy emergency and announced aggressive plans to maximize domestic oil and gas production. Markets reacted by pricing in an anticipated rise in U.S. crude supply, which added downward pressure on global oil prices. Weaker-than-expected demand growth, particularly from China, also played a role in softening prices. As one of the world’s largest consumers of crude oil, China’s reduced demand dampened market expectations. Simultaneously, rising production levels, especially from non-OPEC countries, further contributed to the anticipated global oil surplus. The situation was compounded by sanctions imposed by the U.S. on Russian oil trade, creating short-term disruptions. However, these sanctions prompted Indian refiners to explore alternative sources for crude, primarily from West Asia. Although this added complexity to the supply chain, it did not prevent the overall decline in crude prices. These developments collectively influenced the downward trajectory of crude oil prices, presenting potential economic benefits for India. Lower oil prices can help reduce import costs and alleviate inflationary pressures, providing some relief for the economy. Looking ahead, the situation remains fluid, with factors such as geopolitical developments, global inventory levels, and shifts in major economies' demand likely to shape future oil price trends. For now, India's energy sector may capitalize on reduced costs while navigating a complex and evolving global energy landscape.

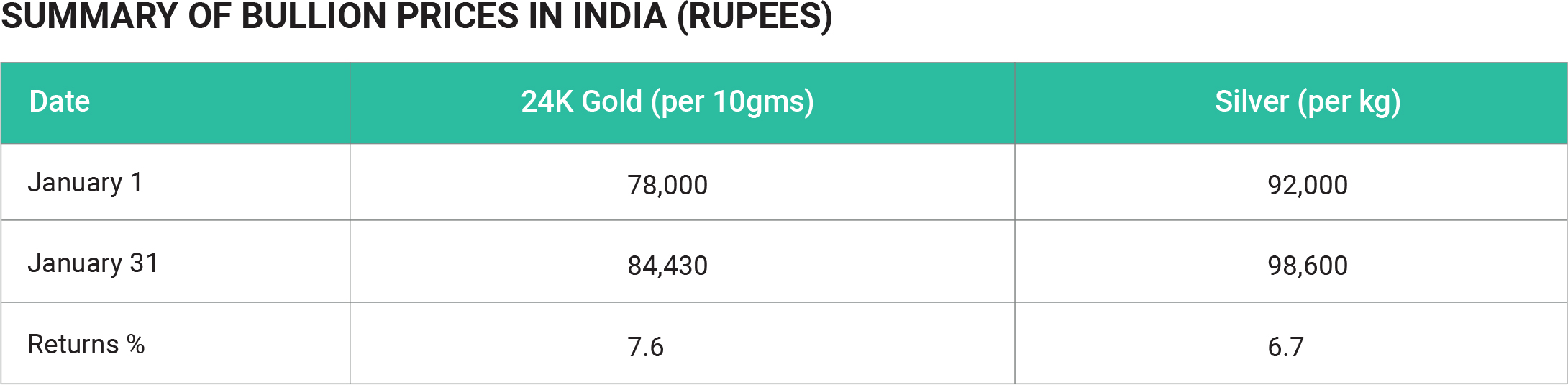

In January 2025, the bullion markets in India, which include gold and silver, experienced fluctuations influenced by various economic factors. Overall, both gold and silver showed positive returns in January 2025, with gold prices increasing by approximately 7.7% and silver by about 6.9%. Geopolitical tensions and economic instability in January 2025 drove investors toward safe-haven assets like gold and silver, boosting their prices. Heightened uncertainty of the Indian rupee against the U.S. dollar contributed to higher local prices for imported commodities, including bullion. Domestic factors also played a pivotal role in supporting bullion prices. The festive season and ongoing wedding demand in India sustained buying interest, further propping up market prices throughout the month. Looking ahead, February 2025 is expected to be dynamic in global markets fueled increased demand for these precious metals. Changes in government policies, particularly regarding import duties and trade regulations, may have positively influenced market dynamics. Persistent global inflation concerns further bolstered interest in gold and silver as investors sought protection against eroding purchasing power. Precious metals are traditionally considered effective hedges during inflationary periods. Additionally, the depreciation for the Indian bullion market. Key factors such as global economic conditions, potential interest rate decisions, Trump administration trade policies, currency fluctuations, and evolving market sentiment will likely shape the trajectory of gold and silver prices. Investors are advised to closely monitor these developments as they navigate an increasingly complex investment landscape.

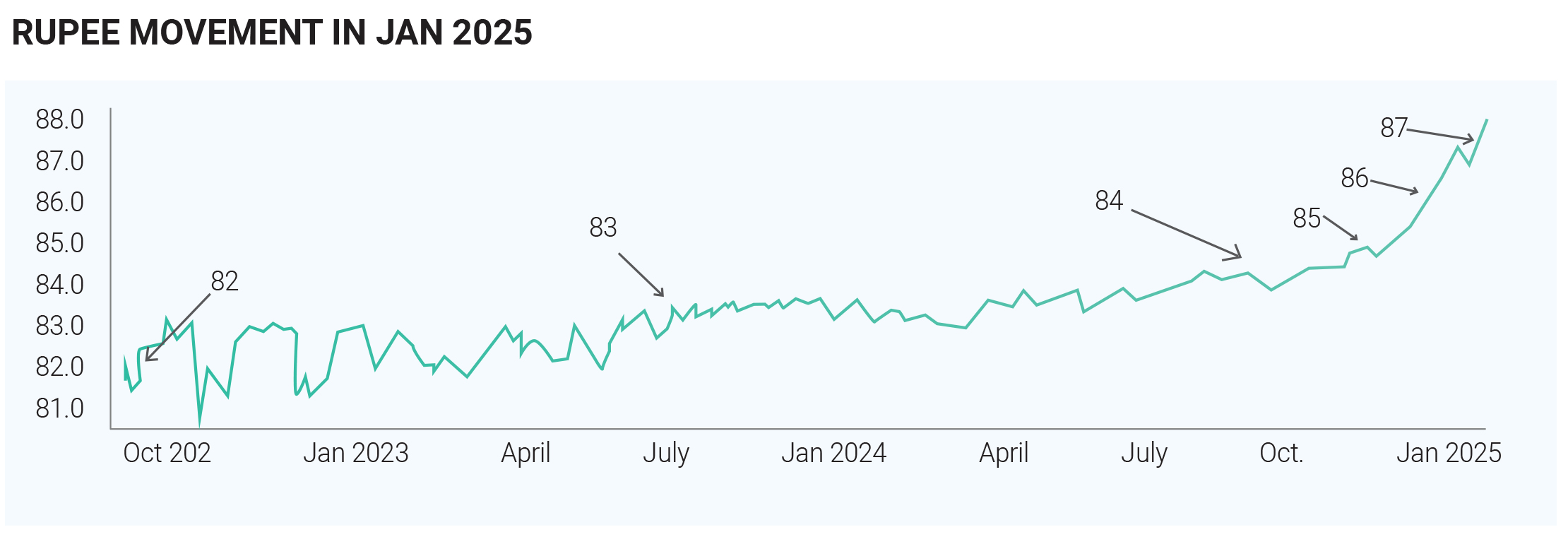

In January 2025, the Indian rupee experienced a notable depreciation against the U.S. dollar, declining from approximately ₹85.56 at the beginning of the month to around ₹86.50 by month-end. This weakening was influenced by several factors, including shifts in U.S. economic policies, key financial indicators, and interest rate decisions that bolstered the dollar's strength. Domestic challenges further exacerbated the situation. India's persistent trade deficit, particularly with China, remains a significant concern. In the fiscal year 2024, the trade deficit with China soared to $85.1 billion. Imports from China rose by 9.8% year-on-year, amounting to $65.89 billion, while exports to China dropped by 9.37%, totalling approximately $8 billion. This imbalance underscores India's reliance on Chinese imports and highlights structural vulnerabilities in its trade ecosystem. As India gears up for Budget 2025, strategic reforms aimed at reducing import dependency and strengthening domestic production are anticipated. Measures to encourage local manufacturing and enhance export competitiveness may help address these economic concerns. The rupee's depreciation was also influenced by inflationary pressures, heightened demand for dollars, trade tensions, and expectations surrounding the Reserve Bank of India's (RBI) monetary policy stance. Moving forward, interventions by the RBI and favourable domestic economic developments could contribute to stabilizing the currency in the coming months.

January 2025 proved challenging for the Indian mutual fund industry, with equity funds posting widespread negative returns amid market volatility and external selling pressures. Despite this, steady growth in SIP contributions and increased interest in sectoral funds highlighted the resilience of retail investors. The debt mutual fund segment stood out, demonstrating strong performance driven by significant foreign inflows and a positive outlook supported by favourable economic conditions and potential policy changes. A stark contrast emerged between sectoral and international mutual funds versus domestic equity funds. While sectoral and international funds benefited from favourable market conditions and investor enthusiasm, domestic equity categories struggled under the weight of negative sentiment and aggressive selling by foreign portfolio investors (FPIs). Looking ahead to February 2025, cautious optimism prevails in the mutual fund landscape. Equity funds are expected to face continued challenges due to lingering market corrections and recent sell-offs. However, debt mutual funds may offer stability and attractive returns, providing a haven for risk-averse investors. The introduction of new fund offerings, along with strategic SIP investments, could create opportunities for investors seeking to capitalize on potential market recoveries. As economic conditions continue to evolve, the mutual fund industry remains positioned for both challenges and opportunities in the months to come

As of January 2025, the Indian insurance sector demonstrated strong growth, with total gross direct premiums for FY 2023-24 reaching approximately ₹11.23 lakh crore, marking a 10% compound annual growth rate (CAGR) over the past five years. The life insurance sector maintained a key role in driving growth, although specific premium figures for FY 2023-24 were not disclosed. Historically, life insurance premiums have been significant contributors to overall market expansion. The non-life insurance segment also grew, reporting a 7.7% premium increase, driven by heightened awareness and regulatory changes. Starting January 2025, commercial property insurance premiums surged by up to 80% due to increased reinsurance costs and regulatory adjustments, signalling a shift toward sustainable pricing models. The Economic Survey 2025 projected that India's insurance market would become the fastest-growing among G20 nations over the next five years. The Union Budget 2025 announced raising the Foreign Direct Investment (FDI) limit for insurance from 74% to 100%, provided premiums are fully invested in India. This is expected to attract substantial foreign investments and support double-digit growth in the non-life insurance sector, with health insurance leading the way alongside emerging segments such as pet and liability insurance. Participation in the Pradhan Mantri Fasal Bima Yojana (PMFBY) rose, with 24 states and 15 insurers involved. Enrolment grew by 26%, reaching 4 crore farmers, enhancing agricultural risk coverage. Despite insurance penetration declining from 4% to 3.7%, insurance density rose from $92 to $95 per capita, indicating greater public awareness of insurance products. Innovations in product development and increased digitalization are expected to make insurance more accessible, particularly in tier 2 and tier 3 cities, fostering further growth and evolution in the sector.

• TAX REFORMS

• Income Tax Changes: The budget raises the

income tax exemption limit to ₹12 lakh, meaning

individuals earning up to this amount will not pay any

income tax under the new regime.

• Standard Deduction: A standard deduction of

₹75,000 is introduced for incomes up to ₹12.75 lakh.

• TDS/TCS Rationalization: The TDS threshold for

senior citizens on interest income is increased from

₹50,000 to ₹1 lakh, and the threshold for rent is raised

from ₹2.4 lakh to ₹6 lakh.

• AGRICULTURE AND RURAL DEVELOPMENT

• Investment of ₹1.52 lakh crore: Focused on

modernizing agriculture and rural development.

• Kisan Credit Card Expansion: Loan limits

increased to ₹5 lakh to improve financial access for

farmers.

• PM Dhan Dhanya Krishi Yojana: Aims to

enhance crop diversification and irrigation in

low-productivity districts

• HEALTHCARE

• Allocation of ₹98,311 crore: Emphasizing

accessibility and affordability.

• Ayushman Bharat Expansion: ₹4,200 crore

allocated for extending health insurance coverage.

• New Cancer Care Centre’s: 200 daycare cancer

centre’s to be established in district hospitals.

• DEFENCE

• Defence Budget of ₹6.81 lakh crore, 9.53%

increase focused on modernization and self-reliance

• Domestic Procurement Focus: 75% of capital

procurement will be sourced from domestic

manufacturers.

• INFRASTRUCTURE DEVELOPMENT

• ₹12 lakh crore allocated: For infrastructure

projects including roads, railways, and airports.

• Maritime Sector Development: ₹25,000 crore

earmarked for shipbuilding and port infrastructure.

• Government will provide ₹1.5 lakh crore in

50-year interest-free loans to states specifically for

capital expenditure projects.

• EDUCATION AND SKILL DEVELOPMENT

• Investment in AI and Research: ₹500 crore

allocated for AI research initiatives.

• Expansion of Medical Seats: Additional medical

seats planned with a target of 75,000 over five years.

• Establishment of 50,000 Atal Tinkering Labs in

government schools and additional medical college

seats planned.

• FISCAL STRATEGY

• Fiscal Deficit Target: Set at 4.4% of GDP for FY

2025-26, down from a revised estimate of 4.8% for FY

2024-25.

• Total Expenditure: Estimated at ₹50.65 trillion

with government receipts projected at ₹34.96 trillion.

• SUPPORT FOR STARTUPS AND MSMES

• Special provisions aimed at enhancing support

for startups and micro, small, and medium enterprises

(MSMEs) to drive innovation and economic growth.

• Emphasis on enhancing manufacturing

capabilities and integrating MSMEs into global supply

chains through dedicated export promotion initiatives.

Copyright © 2021 Fintso