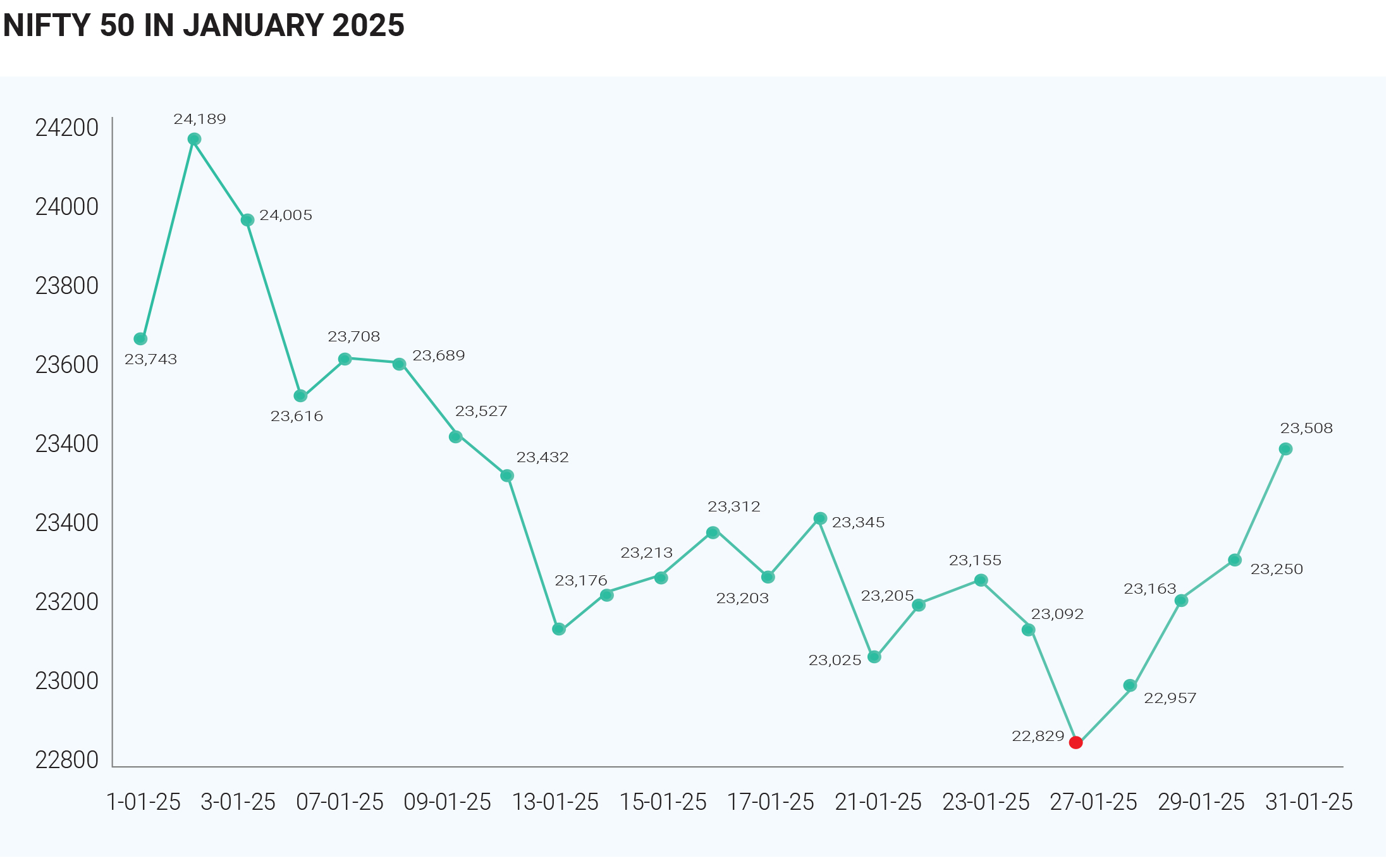

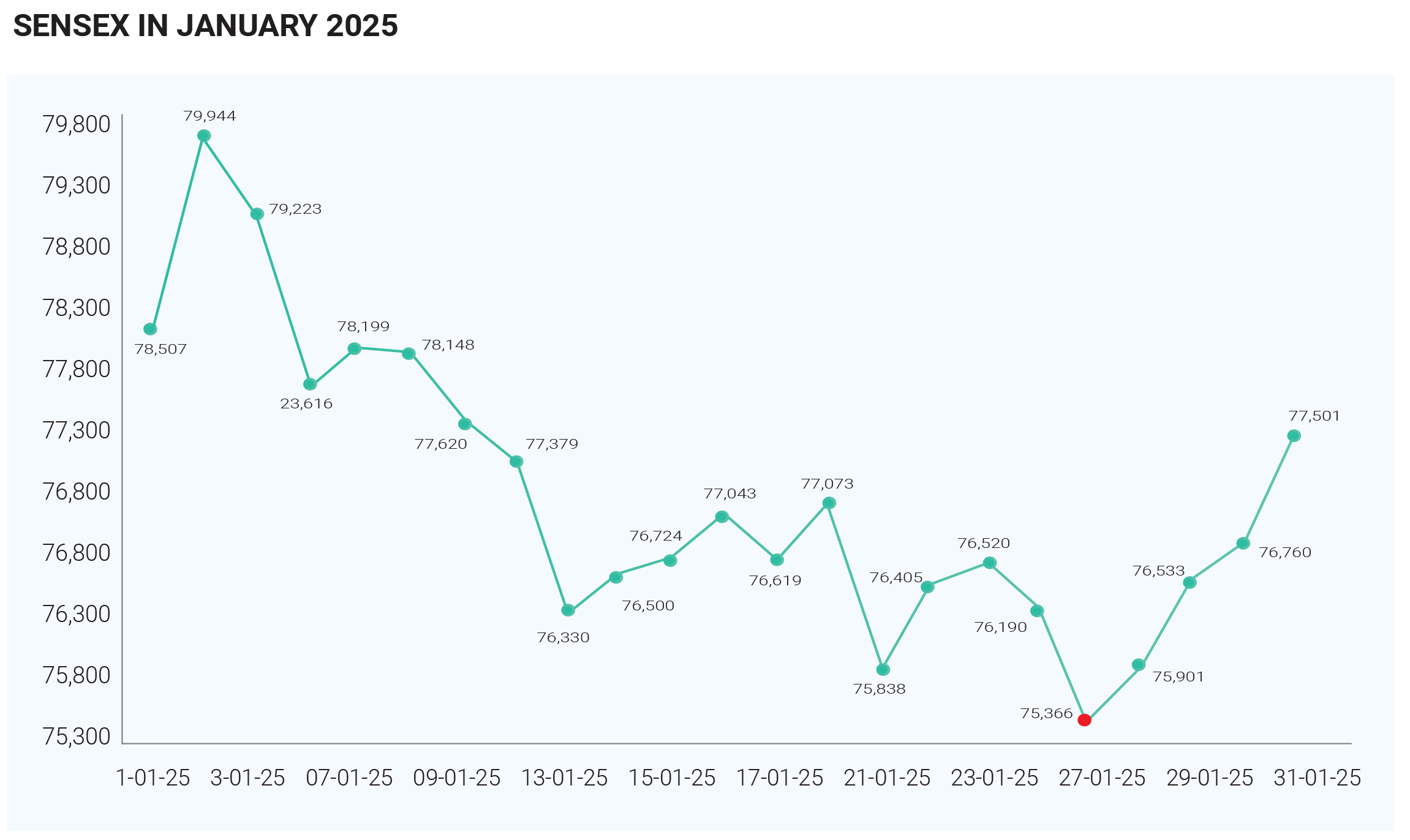

January 2025 proved to be one of the most challenging months for the Indian stock markets in over two decades, as both the Sensex and Nifty indices faced significant downturns. The Sensex declined by around 2%, opening at approximately 78,507 points and closing the month at

Foreign Institutional Investors (FIIs) sold equities worth approximately ₹87,374 crore (around $10.5 billion) in January, marking the largest monthly outflow ever recorded for January and one of the highest in any month historically. This aggressive sell-off hit key sectors hard: Financial Sector: ₹12,200 crore, Consumer Services: ₹3,500 crore, Power Sector: ₹3,115 crore and Capital Goods: ₹2,620 crore Several factors drove this FII exodus, including elevated market valuations, a depreciating Indian rupee against the dollar, rising U.S. Treasury yields, and the imposition of tariffs by the U.S. government on key trading partners, which disrupted global economic stability. The announcement of new tariffs by the Trump administration on imports from major trading partners 76,759 points. Similarly, the Nifty fell from an opening of 23,742 to 23,205 by the end of the month. The decline was attributed to a combination of external economic pressures and domestic factors, creating a turbulent environment for investors.

The Indian market's decline mirrored broader trends in global equities. Poor performance in Asian markets, particularly a 2.56% drop in Japan’s Nikkei, highlighted growing fears of an economic slowdown. Weak global factory activity further fuelled concerns, contributing to market declines across India. On the domestic front, inflation emerged as a major rate-cut cycle by the RBI in early 2025, contingent on inflation data. A reduction of 50 basis points over two policy announcements was under consideration, although any decision would be highly dependent on the inflation trajectory and broader economic conditions. The last week of January saw a glimmer of hope as equity markets began to recover. The sentiment was boosted by the RBI’s announcement of several measures to inject over ₹1 lakh crore of liquidity into the banking system. This move raised expectations of monetary policy easing in the RBI’s February 2025 meeting. Additionally, encouraging earnings updates from prominent U.S. tech companies helped offset fears stemming from renewed tariff threats by the U.S. President and concerns over China’s advancements in artificial intelligence, particularly following the launch of Deepseek. The challenges faced in January 2025 underscore the complex environment for Indian stock markets, shaped by global economic policies, significant FII sell-offs, and domestic economic concerns. As February unfolds, continued volatility is anticipated, driven by global economic conditions and local political events. While there may be opportunities for stock-specific gains, investors are advised to remain vigilant and prepared for market fluctuations as both domestic and international developments continue to influence sentiment.