Topic 2: It is still too early to invest in ‘smart beta’ ETFs

ETFs or Exchange Traded Funds spring from a simple and rather elegant idea. Instead of trying to beat the market, an investor can simply just invest in the market as a whole through an ETF. Being a passive instrument, it typically has lower costs than active funds. This idea first emerged in the US and the ETFs currently are a major force there. However, financial innovators soon added another element to this revolution—they built ETFs around various custom-made indices and branded some of them as ‘smart beta’. Their aim was to give investors some chance at beating the broader market while retaining a low cost and passive structure.

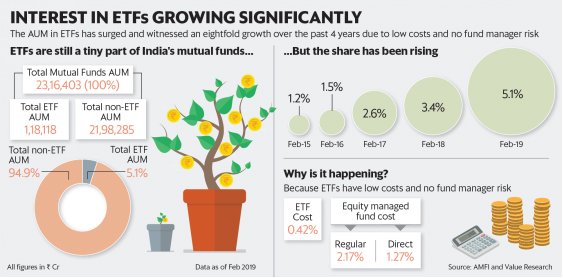

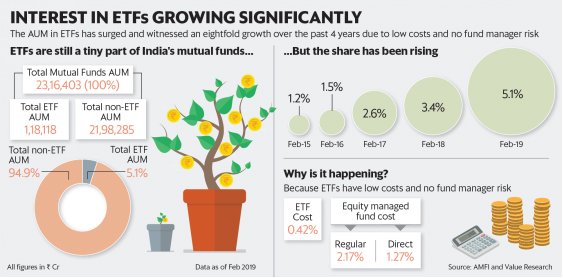

Over the past few years, India has travelled down a similar path. One of its first ETFs, tracking the Nifty 50, was launched on 28 December 2001. This was followed by ETFs tracking the Nifty Junior, gold and the banking sector in the early 2000s. However, the ETF concept has taken off only recently. Over the past few years, many ETFs have been launched. The Employees’ Provident Fund Organisation (EPFO), too, has diverted as much as 15% of its incremental inflows into ETFs. The assets under management (AUM) in ETFs has also surged from around₹14,600 crore in February 2014 to ₹1.18 lakh crore in February 2015—an eightfold growth over the past 4 years (see graph).

New-age ETFs’ indices

Here are some new-age ETF indices:

Nifty Next 50: This index features the 50 largest listed companies immediately after the top 50 largest listed companies by market cap.

Nifty NV 20: This index takes the 20 most ‘value oriented’ companies in the Nifty, selected on the basis of price-to-earnings, price-to-book, and so on.

Nifty Quality Low Vol 30: This index tracks 30 stocks selected from the Nifty 100 and the Nifty Midcap 50 on the basis of ‘quality’ and ‘low volatility.’

Nifty Equal Weight Index: This index assigns equal weights to all Nifty stocks rather than weights based on market cap.

Bharat 22 and CPSE Index: These were set up to meet disinvestment targets and are either public sector dominated or have a significant public sector component.

Should you invest?

Although these ETFs can give investors some niche exposure, the vast majority of investors are better served by ETFs tracking the Nifty or Sensex. However, investors should note that liquidity is poor in many ETFs, pushing up the cost of buying and selling although this is remedied to some extent by investing in fund-of-funds holding the ETF concerned. Also, a specific ETF theme may look smart today but may not be so in the future. In the absence of a fund manager, there is nobody to move the ETF investors to alternative stocks. The indices tracked by the ETFs in question can also be rejigged by the index provider without any reference to the ETF investors. For example, the CPSE Index has undergone several changes since it was launched in 2014.

So, as an investor, approach such ETFs with caution, given the liquidity and rebalancing challenges. At best, they can be ‘satellites’ to a core portfolio of diversified mutual funds.

New-age ETFs’ indices

Here are some new-age ETF indices:

Nifty Next 50: This index features the 50 largest listed companies immediately after the top 50 largest listed companies by market cap.

Nifty NV 20: This index takes the 20 most ‘value oriented’ companies in the Nifty, selected on the basis of price-to-earnings, price-to-book, and so on.

Nifty Quality Low Vol 30: This index tracks 30 stocks selected from the Nifty 100 and the Nifty Midcap 50 on the basis of ‘quality’ and ‘low volatility.’

Nifty Equal Weight Index: This index assigns equal weights to all Nifty stocks rather than weights based on market cap.

Bharat 22 and CPSE Index: These were set up to meet disinvestment targets and are either public sector dominated or have a significant public sector component.

Should you invest?

Although these ETFs can give investors some niche exposure, the vast majority of investors are better served by ETFs tracking the Nifty or Sensex. However, investors should note that liquidity is poor in many ETFs, pushing up the cost of buying and selling although this is remedied to some extent by investing in fund-of-funds holding the ETF concerned. Also, a specific ETF theme may look smart today but may not be so in the future. In the absence of a fund manager, there is nobody to move the ETF investors to alternative stocks. The indices tracked by the ETFs in question can also be rejigged by the index provider without any reference to the ETF investors. For example, the CPSE Index has undergone several changes since it was launched in 2014.

So, as an investor, approach such ETFs with caution, given the liquidity and rebalancing challenges. At best, they can be ‘satellites’ to a core portfolio of diversified mutual funds.